TELECOM RAMBLINGS – December 23, 2013 –

Last year in the US metro/telecom/infrastructure merger marketplace, the pickings were slim once you got past the big deals from Zayo and Lightower. But looking back on 2013, while it was the wireless soap operas that dominated the headlines, the pace of merger activity definitely picked up once again in the US network space.

National network operators were relatively quiet on the M&A front. Zayo was perhaps less active this year following 2012′s run, but they still bought two fiber operators. They added depth up in Minneapolis with the purchase of Access Communications, and they added a unique midwestern route with the purchase of FiberLink. Meanwhile, Level 3 quietly scarfed up the fiber assets of IP Networks Inc in California and Fibrespan in the UK without discussing them much at all. CenturyLink, XO, Cogent, Verizon, AT&T, tw telecom and Windstream were all focusing on other things, though there were of course rumors to the contrary in a few cases. Meanwhile, at the IP layer, GTT took Inteliquent’s data network off its hands, instantly joining the big global backbone club.

The Cable MSOs waded into metro fiber. There were three deals that saw cable operators announce purchases of overlapping metro fiber assets. The biggest was the most recent, TW Cable’s purchase of DukeNet and all that fiber in the Carolinas. The reprecussions of that purchase are still echoing and will affect the 2014 M&A market. But before that, it was Cox buying EasyTel in a focused move for extremely deep fiber out in Tulsa, Oklahoma. And in Florida, Cable Bahamas bought both Summit Broadband and US Metro for their fiber footprints in Orlando and southwest Florida. All three deals strongly suggest that the cable MSOs will be increasingly active in the US metro fiber business from here.

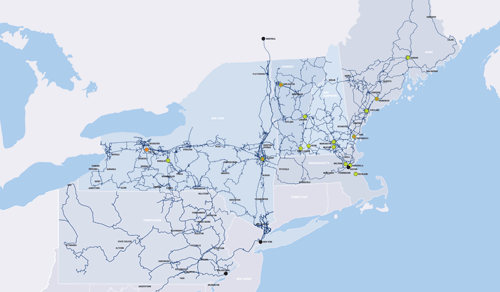

Some regional fiber operators took matters into their own hands — The other general type of deal we saw a lot of this year was the independent regional/metro fiber providers buying more regional/metro fiber. In Los Angeles, Wilcon and Freedom Dark Diber got together, teaming the former’s downtown datacenter loops with the latter’s dark fiber across the greater Los Angeles metro area. With the purchase of Inline PEG Bandwidth added some regional fiber depth in the deep south to go with its wireless backhaul expansion. Up in the far northeast, FirstLight Fiber, (then Tech Valley Communications) made a move to consolidate its hold on the region by purchasing Teljet. The resulting network gives them a strong and unique footprint from Albany over into Maine. And there were two fiber deals out in the state of Washington. Fatbeam moved into Tacoma with the purchase of assets from EMAN Networks. And Wave Broadband made its second regional move in two years by buying Spectrum.