Global consulting firm Deloitte recently released its 2018 Banking Industry Outlook report, highlighting emerging trends in the industry. The top trends include embracing fintech, establishing customer-centricity, adjusting to a changing workforce, and increasing security risks.

Many of the challenges created by these trends can be met by using unified communications. UC ramps up your telecommunications capabilities by providing an entire portfolio of communication and collaboration tools. These tools open up new possibilities for communicating with customers, conducting transactions, and working on projects.

Here’s a look at 5 benefits UC brings to banking and finance:

1) Personalizing Client Experience

Deloitte identified customer-centricity as one of the top trends in the financial industry. Customers want banks and investment firms to take a personalized approach to financial management and planning. This means that financial institutions need to find better ways to interact with customers and clients.

Deloitte identified customer-centricity as one of the top trends in the financial industry. Customers want banks and investment firms to take a personalized approach to financial management and planning. This means that financial institutions need to find better ways to interact with customers and clients.

UC presents numerous options for clients to communicate and interact with financial institutions and investment counselors. Voicemails can be transcribed into emails so they can be accessed from a mobile device. Instant messaging allows customers to communicate with representatives in real time, something that is essential in the fast-paced financial industry. Financial advisors can even conduct face-to-face counseling sessions using WebEx.

2) Increasing Availability

Customers want their financial institutions and advisors to be available at any time. The financial market can change quickly. Customers may need to make a trade at a moment’s notice. Financial emergencies may arise that must be immediately addressed.

The urgency inherent in the financial industry demands that customers be able to reach the right people at the right time. The financial institution’s systems also need to be available at all times for mobile transactions.

UC increases the availability of financial institutions and their employees. Single number reach ensures customers can contact their advisers even when they are away from their desks. Instant messaging empowers customers to converse with representatives in real time.

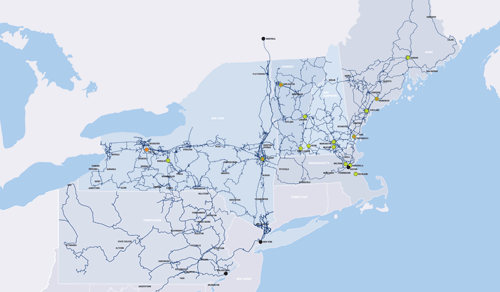

When UC is supported by a high-speed, low latency, fiber optic network, the availability of the entire system increases. Fiber optic networks are reliable and secure, ensuring maximum uptime for banking applications and websites.

3) Documenting Communications for Compliance

The financial industry is heavily regulated because there is so much potential for data theft and related fraud. Financial institutions must handle massive amounts of personally identifiable information that is worth top dollar on the dark web.

The financial industry is heavily regulated because there is so much potential for data theft and related fraud. Financial institutions must handle massive amounts of personally identifiable information that is worth top dollar on the dark web.

Compliance regulations are designed to protect this information by requiring that companies keep meticulous records of transactions for auditing purposes. Access to information must also be strictly regulated.

The Dodd-Frank Act requires that financial institutions record all customer communications. UC makes it possible to do so. All conversations between customers and employees can be recorded, stored, and retrieved when necessary. Records can be kept of all types of interactions, whether they are through email, voice, video, or instant messaging.

4) Accessing More Tools for In-House Communication

The workforce in the financial industry is changing. Like most industries, finance is affected by a growing gig-economy. More workers, especially millennials, are choosing to freelance rather than work permanent, full-time jobs. Many workers are also choosing to work from home.

Financial institutions need to leverage UC to create more ways for remote workers and freelancers to communicate. The new workforce relies on mobile devices to communicate. UC takes advantage of this through single number reach, instant messaging, and web conferencing. These tools allow employees to communicate easily even though they may be separated by distance.

Financial institutions also need to encourage collaborative work practices. Web conferencing and file sharing allow remote employees to work on team projects without having to schedule sessions in a conference room.

5) Faster Decision Making

Time is of the essence in finance. The market is volatile, changing all the time. When an opportunity for a trade arises, a broker needs to act on it right away or lose money.

Time is of the essence in finance. The market is volatile, changing all the time. When an opportunity for a trade arises, a broker needs to act on it right away or lose money.

Many of the tools in UC allow for faster communication. Members of a financial team can communicate quickly through instant messaging to share information needed to make an investment decision. File sharing can be used to send documentation that supports decision making.

When UC is supported by a secure, low latency, high-speed network, financial representatives can be confident that the information they are acting on is current, accurate, and complete.

More Communication Channels With Fewer Risks

UC brings many benefits to financial institutions by creating more means of communication. Employees and customers have numerous options for engaging in conversations and making financial decisions. Because UC opens more channels for communication, a UC provider needs to be able to manage risk for a financial institution.

FirstLight understands the security and compliance challenges that the financial industry faces. That’s why we offer telecommunication tools that are secure and highly available. Our UC offerings for the financial services industry are supported by an extensive fiber optic network. We also offer cloud communications that are scalable and cost-effective.

Meet the communication challenges of the financial industry. Team up with FirstLight for UC.