The unique requirements in the finance industry present challenges for technology. Financial markets are fast-paced. If a transaction or trade isn’t made in milliseconds, customers can miss out on an opportunity, which also negatively impacts the financial institution. Important financial decisions need to be based on real-time information.

Financial organizations also handle a lot of sensitive information on behalf of their clients. If this information falls into the wrong hands, it could result in fraud and financial ruin for customers.

If this information falls into the wrong hands, it could result in fraud and financial ruin for customers.

To meet these challenges, financial institutions need to embrace constantly evolving technology advances. If they don’t, they could be overtaken by the latest surge of startup companies employing fintech, technological advancements that further automate and simplify financial services through the use of electronic currency and mobile banking.

According to 77% of the CEOs that participated in the PricewaterhouseCoopers (PwC) 19th Annual Global CEO Survey, the issue of technology advances was listed as one of the top three influences on stakeholder expectations. As companies in the finance industry look ahead to 2020, they will need to adjust their IT infrastructure to accommodate digital transformation.

Here are 5 technology trends that will affect finance in the near future:

1) Increasing Investment in Fintech

Fintech startups are disrupting the industry by competing with existing financial institutions. Fintech companies use online platforms to provide a better customer experience and accessibility to resources at a lower cost. These fintech startups put existing companies at risk by offering consumer banking, wealth management, and investment services online.

While some incumbents feel threatened by fintech, others plan to embrace the trend by partnering with these in-vogue startup companies. The PwC Global FinTech Report 2017 found that 82% of existing companies plan to join forces with fintech organizations in the next three to five years.

2) Improved Customer Intelligence

In the future, banks and other financial institutions will be working harder to improve customer experiences. As part of a customer-centric approach, banks will offer more services across channels.

New opportunities for customer interaction increase the amount of data financial institutions can use to understand customers better. Data gathered from interactions with customer portals and mobile applications can be used to compile consumer histories that can then be analyzed to predict future behaviors.

3) Growing Concern Over Cybersecurity

PwC discovered that 61% of CEOs from financial institutions are concerned about cybersecurity in this time of global conflict. Financial institutions can become targets of cyber-espionage as nation-states attempt to undermine rival economies. Over half of the CEOs surveyed said they were concerned that data breaches are eroding customer trust in the finance industry.

Increasing use of the Internet of things (IoT) for banking, payments, and insurance has increased the threat to sensitive customer data. Connected devices provide more endpoints through which hackers can access information and infiltrate company systems. To protect themselves, 65% of financial services companies are using cloud-based security.

4) Regulators Using Technology

Since the economic collapse in 2008, the finance industry has become increasingly regulated. Compliance measures such as the Sarbanes-Oxley (SOX) and Dodd-Frank acts hold financial institutions accountable for maintaining records and protecting consumers.

Conducting audits puts a huge burden on regulators. They need to sort through tons of data to find patterns that signal a problem. Regulators are enlisting data gathering and analytics applications to streamline the audit process.

Data analytics enable regulators to be more proactive about helping financial institutions maintain compliance. Analytics can be used to predict impending compliance issues so they can be handled before any harm is done.

5) Mobile Banking

According to the Accenture Strategy Banking Customer 2020 survey, while 20% of banking customers use online services only, customers between the ages of 18 and 34 are two to three times more likely to want additional digital banking services than those 55 and older.

Banking customers are visiting their branches less frequently as they use mobile devices to make payments and transfers or request support. With mobile applications, customers can bank when it is most convenient for them. Mobile banking also enables account holders to receive real-time alerts regarding transaction activity and account status.

Staying on Pace With Digital Transformation

As banks and financial institutions look ahead to 2020, they need to partner with technology providers that understand the specific demands of their industry. Familiarity with the common risks and compliance regulations in finance will ensure a provider can design a digital transformation strategy that makes sense for your business.

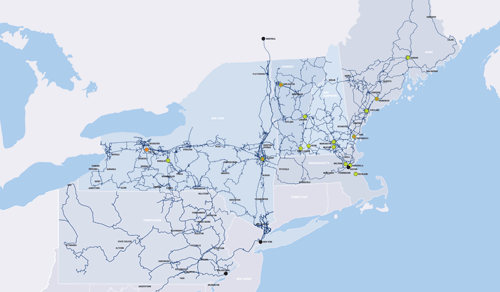

FirstLight has the depth of experience supporting financial organizations from an IT infrastructure perspective. We offer telecommunications, business continuity, and data center solutions designed specifically to support banking and finance organizations. Our high-speed fiber optic network delivers the transaction speeds and security necessary for finance. Our Cloud Communications service streamlines voice communications between your employees, stakeholders, and customers.

Find out why FirstLight is well suited to meet the needs of modern financial services organizations.