Combination with FirstLight Fiber and Oxford Networks will create a stronger Northeast fiber provider

Sovernet Communications (“Sovernet”), a leading fiber-optic bandwidth infrastructure services provider operating in Vermont, New York and southwest New Hampshire, announced today that it has entered into a definitive agreement to be acquired by Oak Hill Capital Partners (“Oak Hill”). At the closing of the transaction, Oak Hill intends to combine the operations of Sovernet with FirstLight Fiber (“FirstLight”), which Oak Hill previously announced an agreement to acquire. FirstLight is another leading provider of fiber optic communications in the northeast.

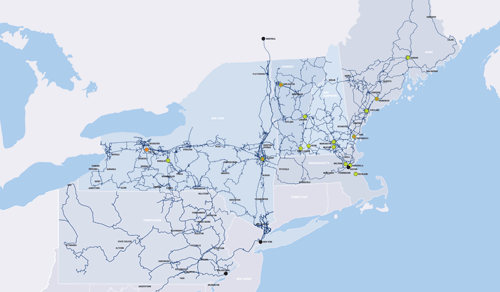

The transaction will combine Sovernet’s high-capacity network transport, broadband Internet, and voice services with FirstLight’s complete portfolio of data, Internet, data center and voice services, which are backed by strong, locally-based service and support. Upon completion of the transaction and Oak Hill’s other pending strategic transactions, including FirstLight and Oxford Networks, the combined companies will operate a total of approximately 9,500 route miles of high-capacity fiber optic network and eleven data centers across New England and New York.

Sovernet’s President and CEO Richard Kendall said, “Sovernet has become a regional leader in high-capacity network transport, broadband Internet and voice services, but this transaction will allow us to do even more to serve our customers. We achieved much in twenty-one years through a combination of dedicated staff, constant reinvestment in the network and remarkable long-term customer relationships. All of these things will continue as we begin a new chapter with FirstLight, which shares our commitment to excellence and is ready to take us to new heights.”

FirstLight Fiber’s President and CEO Kurt Van Wagenen said, “This is an exciting development for FirstLight Fiber. This acquisition is very complementary to FirstLight’s existing network and capability. Once combined, our network will reach further into Vermont, New Hampshire and New York, allowing us to provide high quality, broadband, fiber-based services to more businesses and carriers located in this region.”

In March 2016, Oak Hill agreed to purchase FirstLight from its current owner, Riverside Partners.

Q Advisors, LLC served as financial advisor to ATN, the parent company of Sovernet, and Mintz Levin Cohn Ferris Glovsky and Popeo, PC acted as legal counsel. Paul, Weiss, Rifkind, Wharton & Garrison LLP served as legal counsel to Oak Hill. The transaction is expected to close by early 2017, following the satisfaction of customary regulatory approvals. Financial terms of the transaction were not disclosed.

About Sovernet

Founded in 1995, Sovernet is a leading regional provider of data center, high-capacity network transport, broadband Internet and voice services throughout a 4,500 fiber-mile footprint in northern New England and New York. Sovernet and its Albany, New York-based subsidiary, ION, provide services up to 100 Gbps to enterprise, carrier and government customers throughout the New York and northern New England region. The company is headquartered in Bellows Falls, Vermont with facilities in New York, Vermont and southwest New Hampshire.

About FirstLight Fiber

FirstLight Fiber, headquartered in Albany, New York, provides fiber-optic data, Internet, data center and voice services to enterprise and carrier customers in New York and Northern New England with connectivity to Canada connecting 2,000 locations in service with an additional 14,000 locations serviceable by our 260,000 fiber-mile network. FirstLight offers a robust suite of advanced telecommunications products featuring a comprehensive portfolio of high bandwidth connectivity solutions including Ethernet, wavelengths and dark fiber as well as dedicated Internet access solutions, data center services, and voice services such as SIP trunks, virtual PBX, and traditional TDM solutions. FirstLight’s clientele includes national cellular providers and wireline carriers and many leading enterprises, spanning high tech manufacturing and research, hospitals and healthcare, banking and financial, secondary education, colleges and universities, and local and state governments. To learn more about FirstLight, visit www.firstlight.net, or follow the company on Twitter and LinkedIn.

About Oak Hill Capital Partners

Oak Hill is a private equity firm managing funds with more than $9.0 billion of initial capital commitments since inception from leading entrepreneurs, endowments, foundations, corporations, pension funds, and global financial institutions. Over the past 30 years, the professionals at Oak Hill and its predecessors have invested in 81 significant private equity transactions across broad segments of the U.S. and global economies. Oak Hill applies an industry-focused, theme-based approach to investing in the following sectors: Consumer, Retail & Distribution; Industrials; Media & Communications; and Services. Oak Hill works actively in partnership with management to implement strategic and operational initiatives to create franchise value. For more information, please visit www.oakhillcapital.com.

Forward-Looking Statements

Statements included herein may constitute “forward-looking statements”, which relate to future events, the future performance, or financial condition of FirstLight following the acquisition of Sovernet by Oak Hill. These statements are not guarantees of future performance, condition, or results and involve a number of risks and uncertainties. Actual results and condition may differ materially from those in the forward-looking statements as a result of a number of factors.