FIERCE TELECOM – December 20, 2013 – Service providers purchasing dark fiber in the form of long-term indefeasible rights of use (IRUs) is hardly new, but various factors are driving new interest in a resource that provides limitless amounts of bandwidth.

FIERCE TELECOM – December 20, 2013 – Service providers purchasing dark fiber in the form of long-term indefeasible rights of use (IRUs) is hardly new, but various factors are driving new interest in a resource that provides limitless amounts of bandwidth.

According to a report ATLANTIC-ACM released in April, 27 percent of the wholesale fiber buyers it surveyed said that they had purchased dark fiber services, and 57 percent of those currently buying dark fiber expect to spend more on it in 2014.

So what’s driving new interest in dark fiber?

For one, many of the fiber IRUs that service providers entered into during the mid-1990s “telecom boom” will expire throughout this decade.

Brian Washburn, service director, Global Business Network and IT Services for Current Analysis, said in blog post earlier this year that “expiring IRUs will spur a fresh round of telecom negotiations and deal-making” and that “These new deals would buoy transport, network and infrastructure providers.”

In addition to expiring IRUs, wireless operators are asking for dark fiber as they scale their 4G LTE networks. Competitive telcos such as First Light, FiberLight, Integra, and Zayo have been stepping up their efforts to respond with dark fiber solutions.

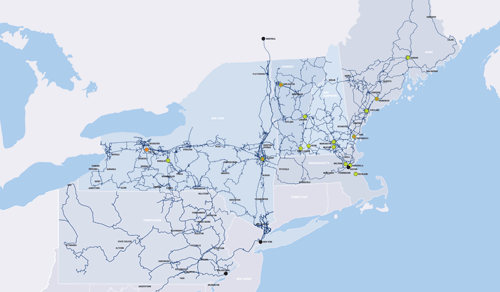

FirstLight, a competitive provider serving the upstate New York and New Hampshire markets, says that dark fiber requests are rising.

“We’re seeing the preferred choice is fiber-based Ethernet services for wireless backhaul, and we’re starting to see some requests for dark fiber as well,” said Kurt Van Wagenen, CEO of FirstLight, in an interview with FierceTelecom. “Given the density of our fiber networks and the markets we operate, we have the ability to offer dark fiber solutions to our wireless carriers and our enterprise customers.”

Van Wagenen added that “it is customer dependent, but we are having those kinds of dark fiber discussions with customers in our region.”

The call for dark fiber is also being seen by cable operators like Time Warner Cable (NYSE: TWC). Earlier this year, the cable MSO announced it would acquire Charlotte, N.C.-based competitive provider Duke Net Communications.

Why it’s significant: The resurgence of interest in dark fiber is cyclical. While the segment in the mid and late-1990s was driven by the emergence of the public Internet, what’s different now is the demand for bandwidth is actually being met by a growing set of wireless and wireline applications that were nonexistent during the early days of the Internet.

Read more: Dark fiber reignites as wireless backhaul heats up – Year in Review 2013 – FierceTelecom http://www.fiercetelecom.com/special-reports/dark-fiber-reignites-wireless-backhaul-heats-year-review-2013#ixzz2oKdo7nnr

Subscribe at FierceTelecom