The average number of cyberattacks has increased by an alarming 67% over the last 5 years for all industries, according to Ponemon and Accenture’s latest Cost of Cybercrime study. The banking industry remains a top target, suffering an estimated loss of $18.37 million in 2018.

Security has always been a concern for financial institutions. Financial data is a tempting target for cybercriminals because it enables them to steal people’s identities, commit credit card fraud, and drain customer accounts.

However, keeping security front of mind isn’t enough. Financial organizations need to continually adapt their security strategies as they change the way they do business. Hackers are notorious for quickly modifying their attack vectors to exploit vulnerabilities in every new technology adopted by companies.

In 2019, financial institutions are using more edge devices, increasing the need for managed edge security and encrypted waves to protect client data as it moves through the network.

Finance on the Edge

For decades, banks have been using ATMs to give customers greater access to their money and account information. This trend toward greater banking access and convenience has expanded beyond ATMs to include wearables that use payment applications and internet of things (IoT) devices that enable clients to make smart trades.

For decades, banks have been using ATMs to give customers greater access to their money and account information. This trend toward greater banking access and convenience has expanded beyond ATMs to include wearables that use payment applications and internet of things (IoT) devices that enable clients to make smart trades.

Additionally, smart speakers allow customers to use voice assistants to conduct bank transactions from the comfort of their home. For example, Capital One Bank allows customers to check balances, monitor transactions, and pay bills using Amazon Alexa.

The Risks of Edge Computing

Banking convenience comes at a price. Edge devices create vulnerabilities for financial institutions, increasing security risk. Every connected device is an entry point that hackers can use to steal sensitive financial data or gain access to the organization’s entire system and database.

Edge devices may use third-party software with default passwords. The customer-facing applications that the devices use may become infected with malware. Many edge devices aren’t designed with data or network security in mind.

Edge devices require that financial data be transmitted from the device to the financial institution. Data in transit is vulnerable to being intercepted by hackers. Attempts by the financial institution to encrypt this data at the application layer while in flight will increase latency which may impact performance, preventing the bank from accessing real-time data and slowing down transaction speeds.

New Security Tactics for the Edge

The proliferation of edge devices in banking and finance means that financial organizations need to rethink their approach to security. Protecting the perimeter doesn’t work when data is being generated at the edge. Banks also need to find methods of encryption that allow them to protect data in flight while keeping up with the pace and volume at which financial transactions are processed.

The proliferation of edge devices in banking and finance means that financial organizations need to rethink their approach to security. Protecting the perimeter doesn’t work when data is being generated at the edge. Banks also need to find methods of encryption that allow them to protect data in flight while keeping up with the pace and volume at which financial transactions are processed.

Managed edge security and encrypted wavelength help protect financial data at rest and in transit while still delivering the performance speed needed.

Managed Edge Security financial institutions access to all the tools they need to protect their network. Instead of draining IT staff resources on monitoring the network, banks and brokerage firms can outsource these duties. Managed edge also provides firewalls, intrusion detection and prevention, content filtering, and identity management.

Encrypted Wavelength protects data 24/7 at Layer 1, while information is in transit. Encryption at this layer enables low latency, preventing performance degradation that frustrates users and impedes transactions. Financial organizations can also acquire the bandwidth they need to prevent crippling bottlenecks.

Earning Customer Confidence

When your company keeps up with data-security demands, your customers trust you and remain loyal. Adopting the latest network and data security tools, such as encrypted wavelength and managed edge security, will keep your business from experiencing a devastating breach that could destroy your reputation.

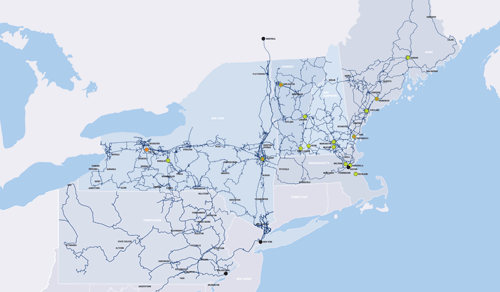

FirstLight offers cutting-edge security solutions for banking and finance, including encrypted wavelength and managed edge security. These solutions are supported by our high-speed fiber optic network so your business can reach the performance speeds it needs while protecting data in flight and at rest.

Our encrypted wavelength offering is ultra-low latency and is available for both 10G and 100G. Our managed edge security services provide a full suite of security tools, along with deep insight into how your network is performing.

Update your security approach today. Find out what FirstLight has to offer companies in banking and finance