Transaction Will Support FirstLight’s Continued Growth

FirstLight Fiber (“FirstLight”), a leading fiber-optic bandwidth infrastructure services provider operating in New York and Northern New England, announced today that Oak Hill Capital Partners (“Oak Hill”) has completed the acquisition of FirstLight. Oak Hill acquired the company from private equity owner Riverside Partners (“Riverside”), which is also investing in the deal and will continue as a minority investor in FirstLight. Financial terms of the completed transaction were not disclosed.

“The acquisition of FirstLight is a key component of Oak Hill’s strategy,” commented Benjy Diesbach, a Partner at Oak Hill. “FirstLight’s strong history as a leading fiber provider in the Northeast and its positive momentum were a few reasons we identified the company as an attractive platform. We welcome the opportunity to support and guide FirstLight in its next stage of growth.”

“Oak Hill is a highly respected private equity firm, and I speak for myself as well as the other members of FirstLight in saying that we’re excited to become an Oak Hill portfolio company,” stated Kurt Van Wagenen, President and Chief Executive Officer of FirstLight. “Oak Hill provides the expertise and financial resources we need at this stage, and together, our potential to continue to meet our customers’ growing connectivity needs is limitless. We also thank Riverside Partners for their support and guidance along this path.”

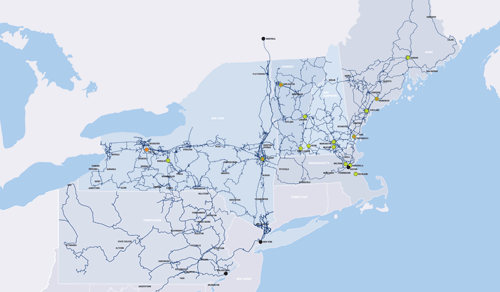

FirstLight originally started as an Albany, New York focused fiber provider and expanded through the acquisitions of segTEL in New Hampshire, TelJet in Vermont and G4 in New Hampshire. During Riverside’s investment period, FirstLight expanded its fiber route miles from 199 miles to over 2,500 miles and today operates a network of nearly 275,000 fiber miles with over 2,000 on-net locations and 14,000 near-net buildings.

“We are extremely proud of all we have accomplished with the FirstLight management team. To have been a part of this company’s impressive growth is gratifying for Riverside Partners, and we look forward to working with Oak Hill to guide FirstLight’s next stage of growth,” said Steven F. Kaplan, General Partner at Riverside and Chairman of FirstLight’s Board of Directors.

“Today, we are excited to formally launch Oak Hill’s strong new partnership with FirstLight management and Riverside. Together, we plan to accelerate FirstLight’s growth through additional investment, including Oak Hill’s pending acquisitions of Oxford Networks and Sovernet Communications. We look forward to many more positive developments for FirstLight,” concluded Scott Baker, a Partner at Oak Hill.

The Bank Street Group LLC served as FirstLight’s exclusive financial advisor in connection with this transaction. Choate Hall & Stewart served as legal counsel to FirstLight in connection with this transaction. Paul, Weiss, Rifkind, Wharton & Garrison LLP served as legal counsel to Oak Hill. TD Securities (USA) served as financial advisor to Oak Hill.