Oak Hill Capital Partners to Acquire Oxford Networks

Lewiston, ME – July 7, 2016 – Oxford Networks (“Oxford”), a leading fiber-optic bandwidth infrastructure services provider operating in Maine, New Hampshire and Massachusetts, announced today that it has entered into a definitive agreement to be acquired by Oak Hill Capital Partners (“Oak Hill”). Under the terms of the agreement, Oak Hill will acquire the company from its current private equity owners, Novacap (“Novacap”) and Bank Street Capital Partners (“BSCP”). At the closing of the transaction, Oak Hill intends to combine the operations of Oxford with FirstLight Fiber (“FirstLight”). FirstLight is another Northeastern U.S. fiber provider for which Oak Hill announced an agreement to acquire from its current owner, Riverside Partners (“Riverside”), in March 2016, subject to prior regulatory approval. Novacap, BSCP and Riverside are expected to continue as minority partners alongside Oak Hill in the holding company for FirstLight and Oxford.

“We are pleased with the outstanding performance that Oxford has delivered for its stakeholders, and we are excited to participate in the next phase of the company’s growth alongside Oak Hill,” said Ted Mocarski, a Partner at Novacap and Chairman of Oxford’s Board of Directors. Oxford began as a local telephone company over 100 years ago. Throughout its long history, Oxford has transitioned itself into a leading regional provider of fiber and cloud services through investments in its network and facilities as well as the acquisition of neighboring BayRing Communications in 2015. During Novacap’s investment period, Oxford more than doubled its core revenues and expanded its network reach to Boston, Massachusetts.

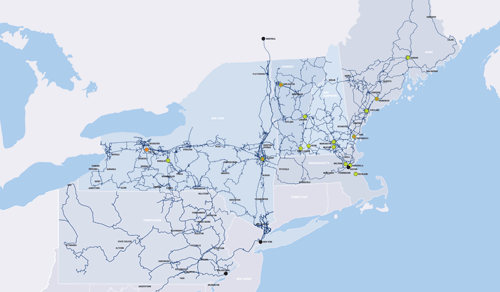

Upon completion of the Oxford and FirstLight transactions, the companies will operate in aggregate approximately 4,800 route miles of high-capacity fiber optic network and ten data centers, the majority of which are SOC 2 (Service Organization Control) certified, in major markets across New York and New England. The transaction represents a compelling strategic fit, as Oxford’s leading presence across Maine, Southern New Hampshire and Northern Massachusetts will complement FirstLight’s strong network across New Hampshire, Vermont and New York.

“Oxford has constructed a high-quality fiber network and developed an outstanding reputation with customers throughout its market territory,” said Benjy Diesbach, a Partner at Oak Hill. “We are excited to continue to build on the positive momentum the company has enjoyed under the ownership of Novacap.”

Scott Baker, a Partner at Oak Hill, added, “The acquisition of Oxford Networks represents a key next step in the execution of Oak Hill’s vision to create a leading fiber provider in the Northeastern U.S. Together with FirstLight, Oxford will be able to offer comprehensive solutions to leading regional enterprises and telecommunications carriers, while also maintaining focus on providing the highest levels of customer service to the companies’ local business communities.”

“This transaction is a very positive development for FirstLight,” said Kurt Van Wagenen, President and CEO of FirstLight Fiber. “Together with Oxford, we will have the scale and fiber density necessary to continue to enhance our capabilities to the benefit of our customers, our employees and the local communities in which we operate.”

Oxford Networks’ President and CEO, Craig Gunderson, said, “The team at Oxford has been successful in transforming the company from a local exchange carrier into a strategic provider of next gen telecommunications and IT services, including a world class fiber optics network, hosted PBX, cloud services and others. We are excited for the next stage of growth, as we will be able to better serve our customers through the expanded network, data centers and product portfolio.”

The transaction is expected to close in the fourth quarter of 2016, following the satisfaction of customary regulatory approvals. Financial terms of the transaction were not disclosed.

MVP Capital LLC served as Oxford’s exclusive financial advisor in connection with this transaction, and Citizens Capital Markets, Inc. served as financial advisor to Oak Hill. Paul Hastings LLP served as legal counsel to Oxford, and Paul, Weiss, Rifkind, Wharton & Garrison LLP served as legal counsel to Oak Hill. TD Securities (USA) LLC is acting as Sole Bookrunner and Joint Lead Arranger with Citizens Bank, N.A., Pacific Western Bank and Webster Bank, N.A. for the senior secured credit facilities. The second lien facility has been directly placed.