Financial organizations face unique challenges when developing disaster recovery strategies. Most organizations have an enterprise continuity plan (ECP) that includes disaster recovery. Unlike in other industries, having an effective disaster recovery plan is a requirement in finance. The Federal Financial Institutions Examinations Council (FFIEC) issued requirements in 2015 that were influenced by the effect that Hurricane Katrina had on banks.

Being able to quickly recover from a disaster is crucial for the finance industry because these institutions are so reliant on digital records and applications in the day-to-day transactions they perform on behalf of clients. PricewaterhouseCoopers’ Financial Services Technology 2020 and Beyond: Embracing Disruption report lists 10 ways technology is transforming finance, including through the use of artificial intelligence, predictive analytics, and public cloud adoption. All these technological innovations need to be protected from natural disasters and major breaches.

An effective disaster recovery plan for a financial institution needs to ensure not only business continuity but also the protection of sensitive data. Cloud-based disaster recovery combined with a fast and secure network is ideal for companies in the finance industry.

Protecting Data in Transit

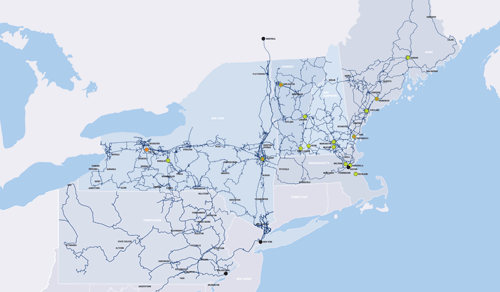

To ensure data is protected after a natural disaster, an outage, or a breach, financial institutions need to leverage a third party colocation facility or cloud environment for their primary or backup data center. The geographical diversity provided by employing a secondary site should reduce the chance that an institution could be negatively affected by a single, localized issue.

However, when data is being rerouted to a disaster recovery site, it is susceptible to being lost or stolen. For this reason, the disaster recovery strategy needs to include the use of a secure network. Fiber optics help provide this security. Unlike copper cables, fiber optic networks are difficult to hack, and breaches are more easily detected when traffic is interrupted.

Maintaining Compliance

The financial services industry is heavily regulated to guard against fraud and protect clients’ private information. Compliance regulations such as Dodd-Frank and the Payment Card Industry Data Security Standard (PCI DSS) require that transaction records be preserved for a sufficient period of time so audits can be performed. The Sarbanes-Oxley Act demands that data storage, access, and retrieval be strictly controlled and that transaction records be maintained.

To maintain compliance, a financial institution should develop a disaster recovery strategy with a partner that is familiar with these regulations. The disaster recovery solution needs to provide archiving in a secure location with redundant systems to prevent data loss or compromise.

Preserving Business Continuity

In this fast-paced industry, maintaining uptime is critical. Minutes can cost organizations millions in lost transactions and unhappy customers.

In this fast-paced industry, maintaining uptime is critical. Minutes can cost organizations millions in lost transactions and unhappy customers.

If a natural disaster, a major equipment failure, or an outage interrupts financial transactions, the institution’s reputation may experience irreparable damage. For example, a ransomware attack could shut down business for days while a bank tries to find a fix. Clients will lose confidence and trust in the bank and deposit their money elsewhere.

Disaster recovery as a service (DRaaS) enables a financial organization to achieve instant failover to a redundant cloud environment. Data backup can be synchronized to accelerate recovery time and recovery point objectives. Meeting these objectives ensures that financial transactions can be made based on current and accurate information and that service is uninterrupted.

Meeting the Disaster Recovery Challenges in Finance

When choosing a DRaaS provider, financial organizations should opt for one that understands industry-specific challenges. A partner that offers cloud-based disaster recovery can provide the geographical diversity and level of business continuity necessary for giving your business peace of mind and winning your clients’ trust.

FirstLight’s DRaaS solution includes award-winning replication and recovery software. We combine a robust cloud computing infrastructure with ultra-low latency network solutions to eliminate downtime. Our fiber optic network provides the speed necessary to make crucial financial transactions. We are also experienced in providing business continuity services for banking and finance and understand industry compliance regulations.

Make sure you meet the disaster recovery requirements of the finance industry. Team up with FirstLight for DRaaS.