As a highly regulated industry, financial services has been wary adopting cloud technology. But that is changing.

In the past, concerns about storing sensitive financial and personally identifiable information in the cloud has been key factors in slowing adoption. This financial information is a gold mine for cybercriminals. Storing such lucrative information in a multi-tenant environment or transmitting it from a secure data center to the cloud seemed too risky.

Today, the financial services industry is beginning to understand that embracing the cloud affords many benefits due of its flexibility and data protection capabilities.

On the Road to Digital Transformation

The cloud enables financial services organizations to update their legacy infrastructures. Older hardware can’t meet the performance demands of today’s workloads. Yet, provisioning new hardware or upgrading legacy solutions can be expensive and time-consuming.

The cloud enables financial services organizations to update their legacy infrastructures. Older hardware can’t meet the performance demands of today’s workloads. Yet, provisioning new hardware or upgrading legacy solutions can be expensive and time-consuming.

With the cloud, companies can access the latest technology to store data and run applications. The right cloud provider will stay current with any technology updates and refreshes. With cloud infrastructure, scaling to meet new demands is easy and cost-effective.

Many financial services organizations are adopting a cloud-first strategy so they can leverage innovations in advanced analytics, such as artificial intelligence (AI). The machine learning and natural language processing capabilities of AI enable financial companies to provide better customer experiences. AI can also analyze transactional data to detect fraud attempts and unethical trading practices.

Balancing Security and Accessibility

Hybrid cloud allows financial services organizations to use separate environments to store sensitive data and run client-facing applications. Financial services companies can use on-site private cloud to store and access sensitive information. Applications that clients and customers use to make transactions can be run in the public cloud for greater accessibility. Furthermore, cloud providers have made security a top priority, offering firewall as a service and achieving SOC 2, PCI, HIPAA, and other certifications that require strict privacy standards.

Many financial services institutions are starting to use the cloud for security and data protection. PricewaterhouseCoopers’ Financial Services Technology 2020 and Beyond report found that 65% of financial services companies are using cloud-based security.

Hybrid cloud provides data protection through off-site backup, eliminating the need for a secondary physical location. The cloud can also achieve instant failover for disaster recovery, ensuring the level of business continuity that financial institutions need in order to earn and keep client confidence.

Expanding Your Reach

The cloud delivers greater agility and scalability than on-site solutions, enabling financial companies to grow more quickly. Banks, investment companies, and insurers can reach more people in more ways thanks to the opportunities the cloud creates for running new applications.

The cloud delivers greater agility and scalability than on-site solutions, enabling financial companies to grow more quickly. Banks, investment companies, and insurers can reach more people in more ways thanks to the opportunities the cloud creates for running new applications.

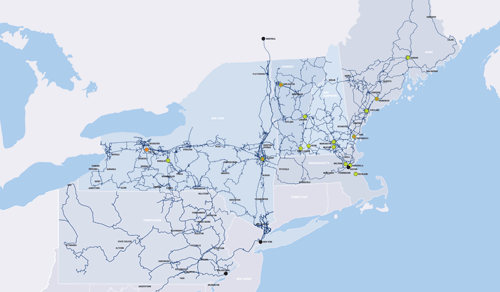

The cloud also provides geographical diversity by offering a choice of data centers. With the right cloud provider, this geographical diversity can allow your financial services company to achieve a global reach.

Many U.S. banks already work with European companies and investors. According to the above-mentioned PricewaterhouseCoopers report, Asian countries ― especially China ― will create the greatest opportunity for financial services companies because of their rising middle class.

Finding the Right Cloud Provider for Finance

Not every cloud provider will be equipped to meet the security and compliance needs of financial services organizations. Banks and other financial institutions need to work with cloud partners that meet strict compliance regulations for storing and accessing sensitive data. These companies also need to work with cloud providers that allow them to maintain control over their data and other technology assets.

FirstLight understands the unique challenges the financial services industry faces when using technology. We have a complete portfolio of services designed specifically to meet the security and business continuity needs of banking and financial organizations. These services include cloud offerings supported by our secure and high-speed fiber optic network.

Learn more about how FirstLight’s cloud can enhance your financial services organization. Reach out to FirstLight today.