The finance industry is going through a digital transformation. PricewaterhouseCoopers reported that the global investment in financial technology has tripled since 2014 to reach over $12 billion.

More and more financial institutions are interacting with customers through mobile devices. G2 Crowd, a business solutions reviewer, predicted that mobile payments will increase by 60% between now and 2021.

Technologies such as blockchain are changing the way financial transactions are conducted. Blockchain enables financial institutions to keep digital copies of ledgers on every computer in the network, as well as speed up transfers and trades.

Digital transformation is creating additional technology challenges in an already-demanding industry. Finance is a fast-paced industry that requires a high-speed network. When investors’ money is on the line, every millisecond counts.

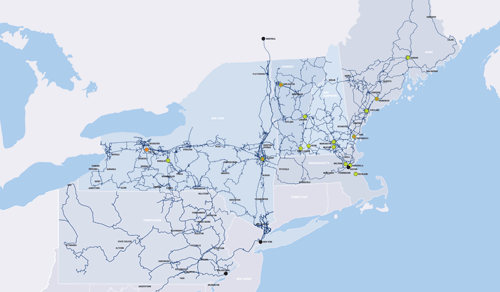

Finance companies need to support their technology with high-speed fiber optic networks to ensure data moves quickly and arrives at its destination intact and accurate.

The Accelerated Pace of Finance

Customers rely on banks, credit unions, and brokers to respond quickly to their financial requests. The financial market can be volatile. The rise of artificial intelligence (AI) will no doubt have an impact on investment decisions and in some cases, not just seconds but milliseconds could be the difference between success or failure.

Customers rely on banks, credit unions, and brokers to respond quickly to their financial requests. The financial market can be volatile. The rise of artificial intelligence (AI) will no doubt have an impact on investment decisions and in some cases, not just seconds but milliseconds could be the difference between success or failure.

If a network is down or slow, transactions can be missed, and missing out on a trade may mean losing thousands of dollars or more. Investors need to buy or sell stocks in a timely manner to avoid risk and get the most return on their investment.

Aside from trading, customers are increasingly using mobile devices to make daily financial transactions. The Bank of America Trends in Consumer Mobility Report for 2018 found that 34% of consumers use mobile devices to make payments. Additionally, 75% reported using mobile banking apps, and 33% said they often go an entire week without using cash.

Consumers need reliable and secure access to the technology they use for payment and personal financial decision making. Even the best mobile / consumer experience that fails to maintain reliability will have an inverse effect on consumer loyalty. Simply put, consumer standards for access to technology are higher than ever and that isn’t likely to change anytime soon.

Keeping Financial Data at Your Fingertips

To make crucial investment decisions, financial institutions need to have access to current market and investor data. Financial decisions must be made based on real-time data. Volatility in the market means the information needed to make decisions changes rapidly. The market could tank early in the day and recover by the closing bell.

To strike while the iron is hot, financial institutions must maintain the highest levels of availability and the lowest levels of latency possible. Financial organizations should leverage a high-speed fiber optic network that can move information at the speed of light with minimal latency, allowing them to access and transmit data quickly.

Making the Most of Financial Data

Financial institutions rely on advanced analytics to make complex decisions for investors. Artificial intelligence (AI) uses powerful applications to process huge volumes of unstructured data. These applications mine data from all over the organization, such as transactional and customer histories.

Financial institutions rely on advanced analytics to make complex decisions for investors. Artificial intelligence (AI) uses powerful applications to process huge volumes of unstructured data. These applications mine data from all over the organization, such as transactional and customer histories.

This information is then processed by analytics applications to make customer service, operational, risk management, and investment decisions. Performance power and speed of processing are necessary to make these advanced applications work.

Combining Speed and Security

Financial data must be transmitted both quickly and securely. Protecting data in flight prevents financial fraud and identity theft.

FirstLight understands that financial information needs to be encrypted while in transit without interfering with performance speed. That’s why we offer an encrypted wavelength solution that protects data at the transport layer.

Encrypted wavelength enhances the quality of our fiber optic network offerings for banking and finance, so data in transit is protected 24/7.

Is your company operating at the speed of finance? Find out more about our tailored solutions for financial service institutions here.